RV Market Industry Overview from J.D. Power

Recreational Vehicles – Q2 2022

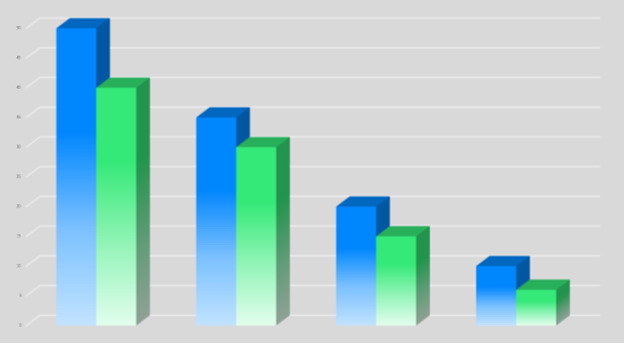

All segments of the RV market have moved off their respective peaks, but pricing is still strong by historical standards.

Looking at individual segments, the most recent 10 years of Class A motorhome values averaged 16.0% higher pricing in the first half of 2022 compared to the same period of 2021. Class C motorhomes averaged 21.9% higher over the same period. In trailer segments, standard hitch units averaged 25.7% higher pricing in the first half of 2022 compared to the same period of 2021. Fifth-wheel units averaged 13.8% higher pricing over the same period, camping trailers averaged 29.1% higher, and truck campers averaged 19.1% higher.

All segments have crested the peak in pricing, we’ll see year-over-year parity followed by mildly negative comparisons going forward. Large-scale economic changes are causing markets for discretionary and luxury items to mature, but a tight supply should help keep pricing healthy going forward.

Travel Trailer Values

Average Retail Value by Category – Values for the Last 10 Model Years

Standard Hitch

Fifth Wheel

Motorhome Values

Average Retail Value by Category – Values for the Last 10 Model Years

Class A

Class C

Camping Trailer & Truck Camper Values

Average Retail Value by Category – Values for the Last 10 Model Years

Camping Trailer

Truck Camper

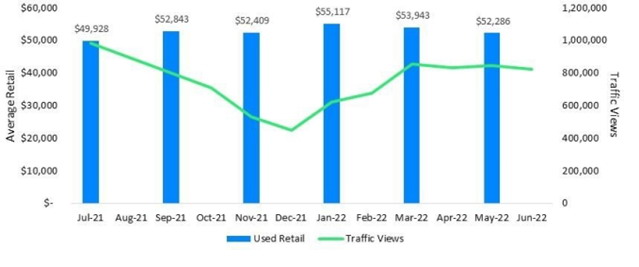

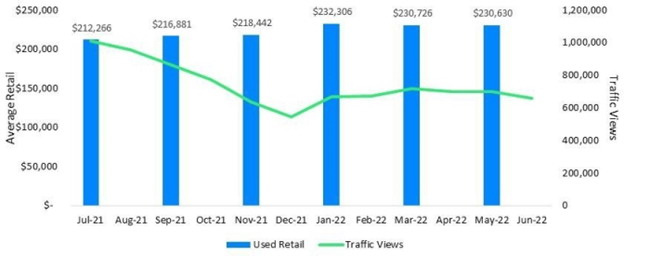

Travel Trailer Values vs. Traffic

Average Retail Value and Traffic View by Category

Standard Hitch

Fifth Wheel

Motorhome Values vs. Traffic

Average Retail Value and Traffic View by Category

Class A

Class C

Camping Trailer & Truck Camper Values vs. Traffic

Average Retail Value and Traffic View by Category

Camping Trailer

Truck Camper

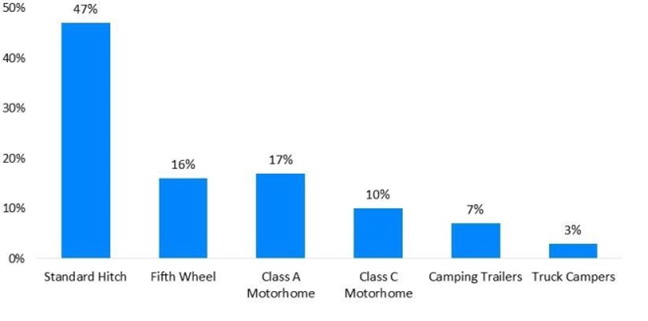

RV Categories

Views in 2022 Q1-Q2

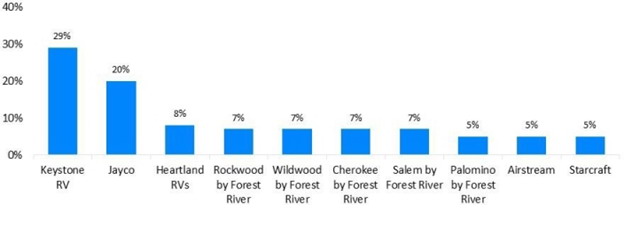

Travel Trailer Brands

Top Researched Brands in 2022 Q1-Q2

Standard Hitch Brands

Fifth Wheel Brands

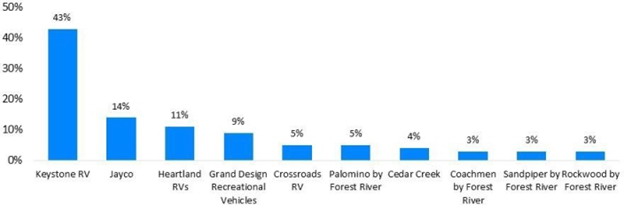

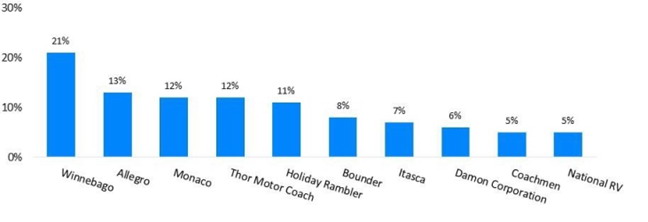

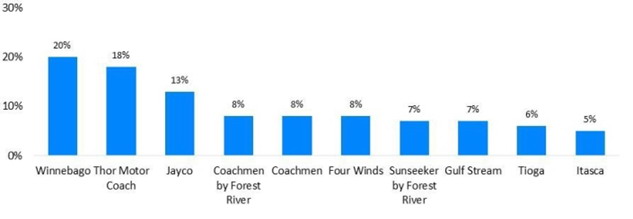

Motorhome Brands

Top Researched Brands in 2022 Q1-Q2

Class A Brands

Class C Brands

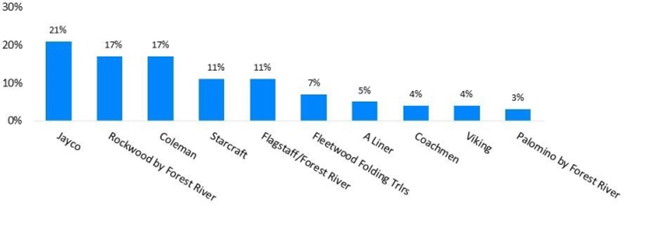

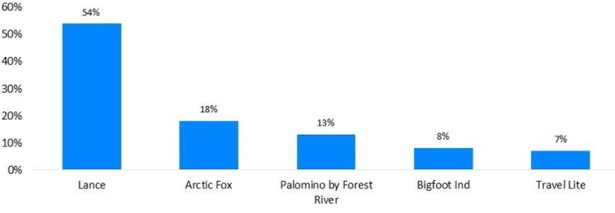

Camping Trailer & Truck Camper Brands

Top Researched Brands in 2022 Q1-Q2

Camping Trailer Brands

Truck Camper Brands

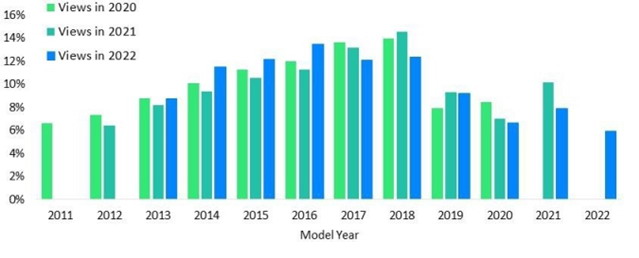

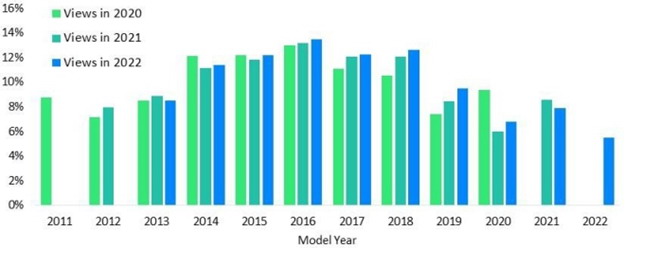

Model Years

Top Researched Model Years by Category

Standard Hitch Travel Trailer

Class A Motorhome

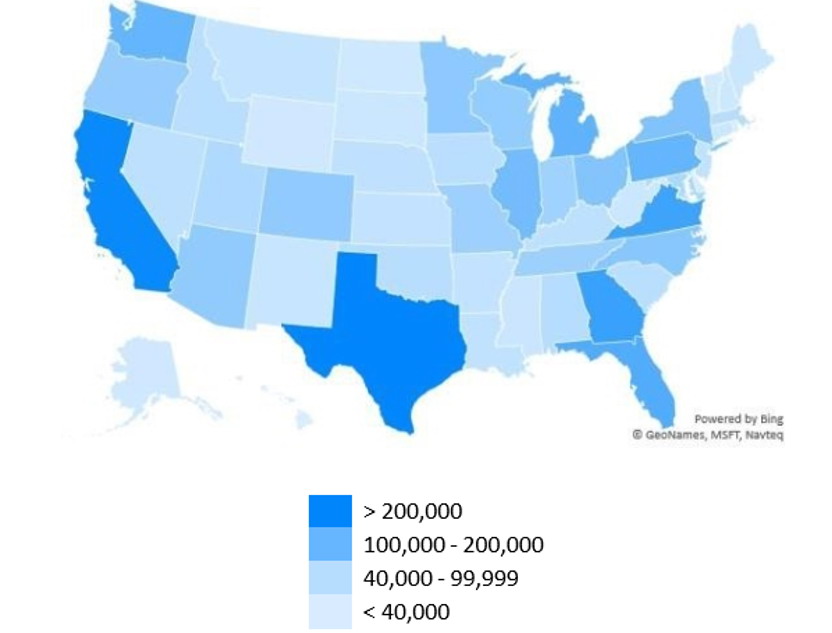

Web Traffic by State

Traffic by State in 2022 Q1-Q2

Travel Trailers

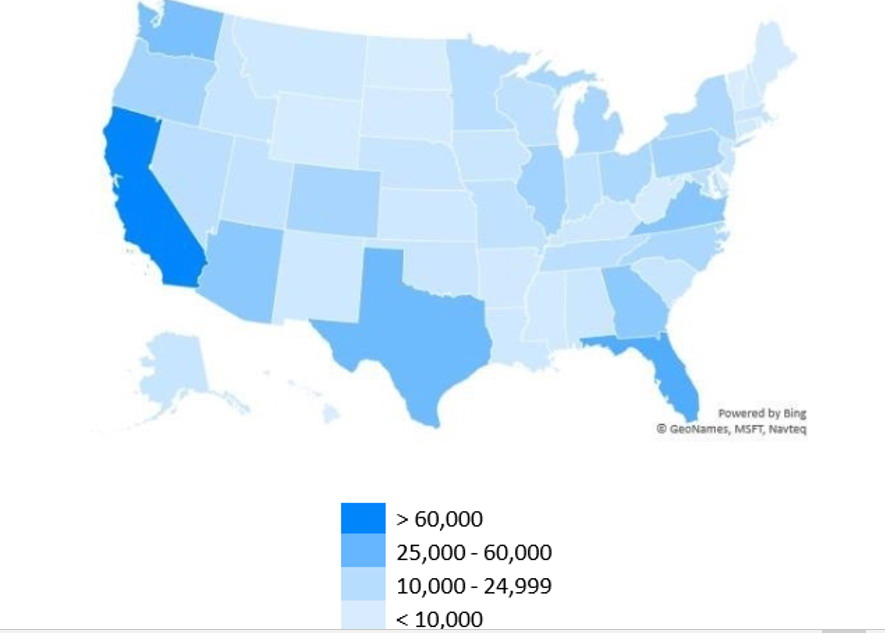

Web Traffic by State

Traffic by State in 2022 Q1-Q2

Class C Motorhomes

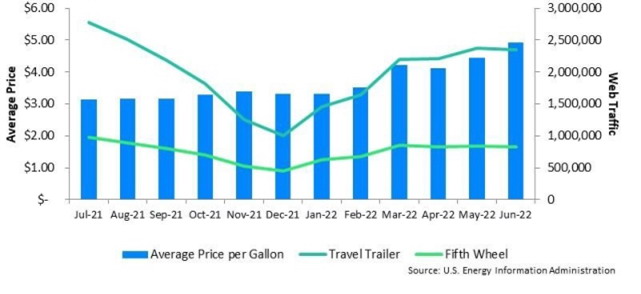

Fuel Price Data

Regular Grade Gasoline Prices vs. Consumer Traffic by Category

Travel Trailer / Fifth Wheel

Motorhomes

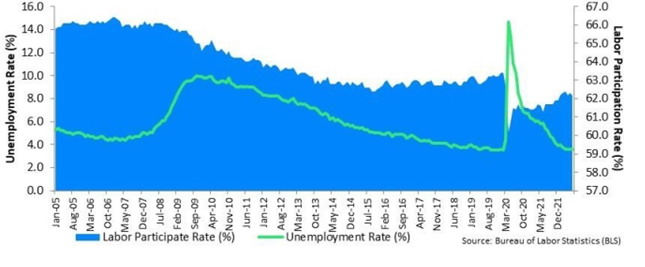

Economic Data

Unemployment & Labor Participation Rate (Seasonally Adjusted)

Disclaimer

J.D. Power makes no representations about future performance or results based on the data and the contents available in this report (“Market Insights”). Market Insights is provided for informational purposes only and is provided AS IS without warranty or guarantee of any kind. By accessing Market Insights via email or the NADAguides.com website, you agree not to reprint, reproduce, or distribute Market Insights without the express written permission of J.D. Power.

J.D. Power Specialty Vehicles

J.D. Power is the largest publisher of the most market-reflective vehicle pricing and information available for new and used cars, classic cars, motorcycles, boats, RVs and manufactured homes, offers in-depth shopping and research tools including a broad range of data, products and service and informational articles as well as tips and advice.

J.D. Power also produces electronic products, mobile applications, raw data, web services, web-syndicated products and print guidebooks.

J.D. Power (800) 966-6232

Fax (714) 556-8715