Analyzing the Q4 2023 Pre-Owned RV Sales Statistics…

An RV Dealer News Exclusive Report by Nick Farnell

If you are familiar with the 2011 movie Moneyball, you will recognize how much of an advantage you can gain over your opponents by using data. In that movie (a true story about the Oakland A’s) Billy Beane outsmarts the richer teams by leveraging analytics in his decision making. The same approach can be applied to many industries including recreational vehicle sales. This article just scratches the surface on some of the patterns in sales of pre-owned recreational vehicles in the final quarter of 2023.

For a much deeper analysis of sales for the fourth quarter of 2023, visit https://wtrfll.ca/sales-reports/ . For a limited time, readers of RV Dealer News will receive $150 worth of downloads using the code RVDEALER at checkout, no minimum spend required.

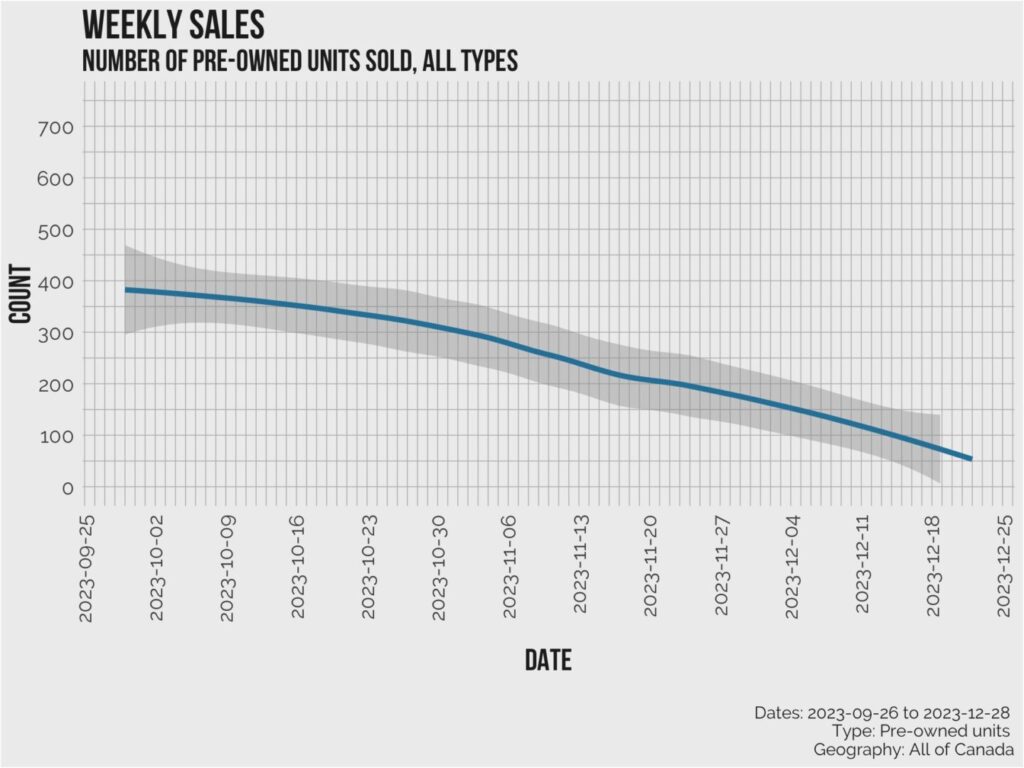

Weekly sales of pre-owned recreational vehicles remained fairly strong through October and saw a significant drop off with the arrival of November. By the last week of the year, there were fewer than 60 sales of pre-owned vehicles across the country.

Pre-owned RV Sales by Region, Q4 2023

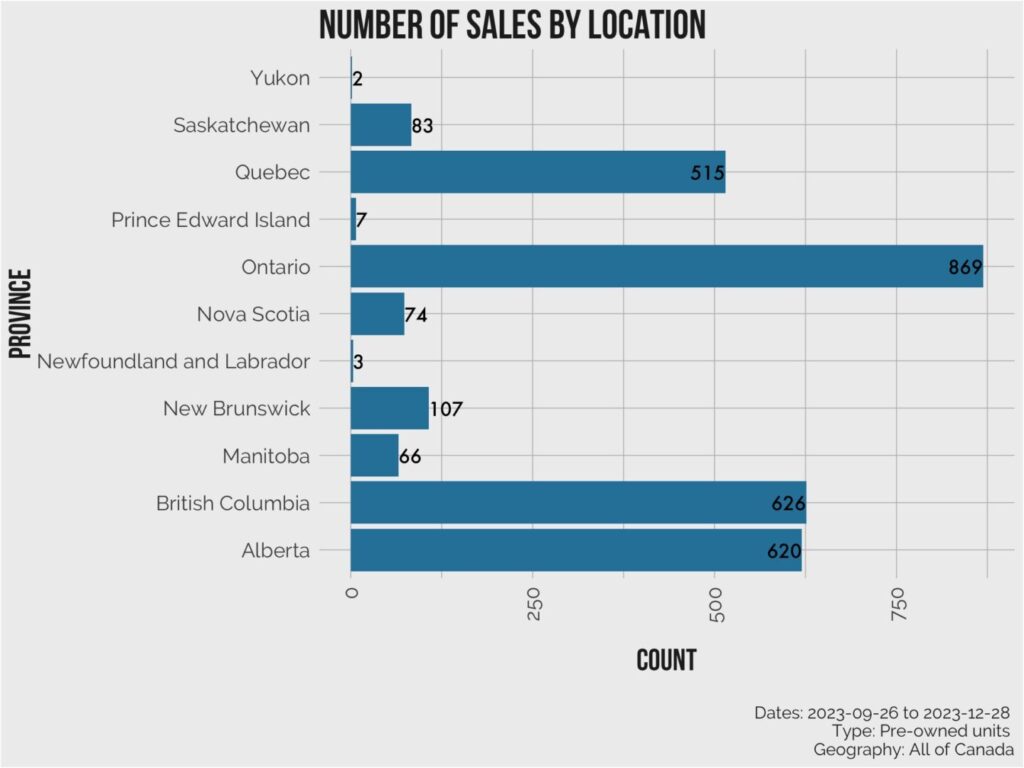

Of the 3,182 pre-owned recreational vehicles sold during the fourth quarter of 2023, Ontario dealerships sold 869 which is substantially more than any other province. That is not entirely surprising since Ontario is by far the largest province by population.

191 pre-owned units were sold in Atlantic Canada and 1,395 in Western Canada.

High population numbers do not always equal high sales numbers however, highlighted by the fact that few units are sold in some of Canada’s largest cities. Toronto and the surrounding area has a population of over 6 million but fewer than 100 pre-owned units were sold in the last 3 months of 2023.

Looking deeper into regional sales, Edmonton, Alberta and the surrounding area sold more RVs than any other place in the country, with approximately 350 pre-owned units sold.

The next closest was the Niagara region in Ontario that sold approximately 200 units in this same time period.

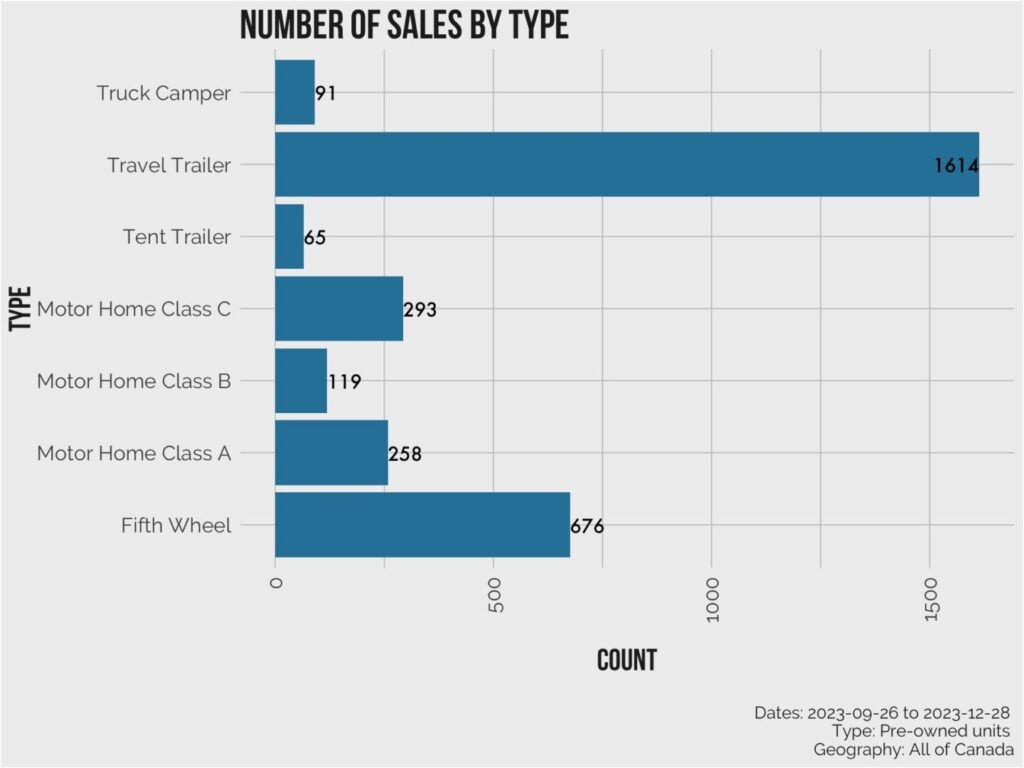

Sales by category

In the final 3 months of 2023 the most common type of pre-owned recreational vehicle was travel trailers. 1,614 travel trailers were sold during this time representing over 50% of all pre-owned sales across the country, with the next most common type being fifth wheel trailers with just over 21% of total pre-owned sales. Truck campers and tent trailers each had fewer than 100 units sold.

This pattern is fairly consistent across the country with some slight regional variations. In Atlantic Canada travel trailers were more common than in the rest of the country, accounting for approximately 60% of all pre-owned sales. Western Canada saw a higher proportion of fifth wheel trailers with nearly 24% of pre-owned sales – approximately 3% higher than the national average.

Price differences by province

Manitoba tended to have lower average prices at $40,534 vs the national average of $58,238. The average price of travel trailers specifically was lower in Manitoba compared to the rest of the country at $24,106 compared to $33,270 nationally.

Older vehicles tend to have lower prices compared to newer vehicles, but in this case the average age of units sold in Manitoba was not substantially different than in other provinces.

On the other side of the coin, motorhomes tended to sell at a higher price in Atlantic Canada than in other parts of the country, all else being equal.

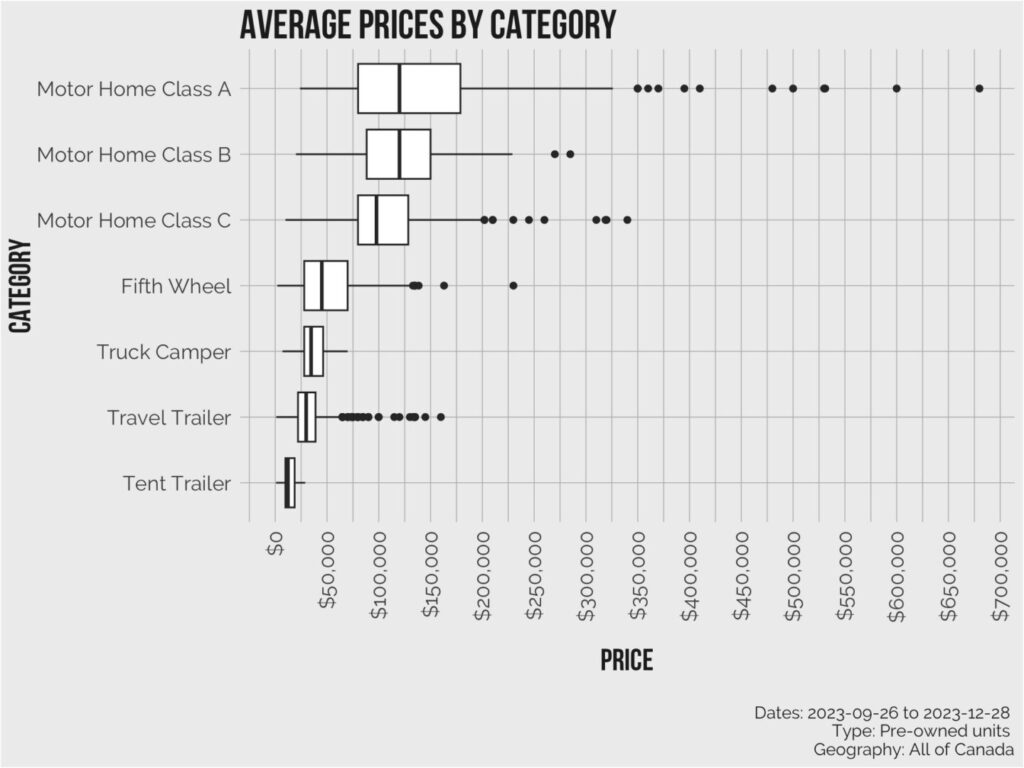

Price differences by RV type

Motorhomes were by far the most expensive units sold during the last 3 months of 2023. On average, pre-owned class a motorhomes sold for approximately $146,000, class b for $118,000 and class c for $107,000.

Fifth wheels were the second most expensive category selling for approximately $50,500 on average.

Pre-owned travel trailers averaged nearly $33,000 and tent trailers approximately $11,000.

Having a high-quality data source is the first step in using the power of data and analytics to inform decision making. Just like Billy Bean and the Oakland A’s in Moneyball, dealerships can leverage these tools to gain an advantage over their competitors in this increasingly competitive space.

About the author…

Nick Farnell, MBA

Nick Farnell is a professor of business analytics and runs the consulting firm wtrfll, focusing primarily on competitive intelligence and data driven insights. When not in front of a computer, he is spending as much time as possible in one of Ontario’s provincial parks with his young family.

Please vist https://wtrfll.ca/ to see how Nick and his team have helped organizations use data and analytics to better understand their customers and competitors.