Pre-owned sales data – Canada Q3 2024

By Nick Farnell

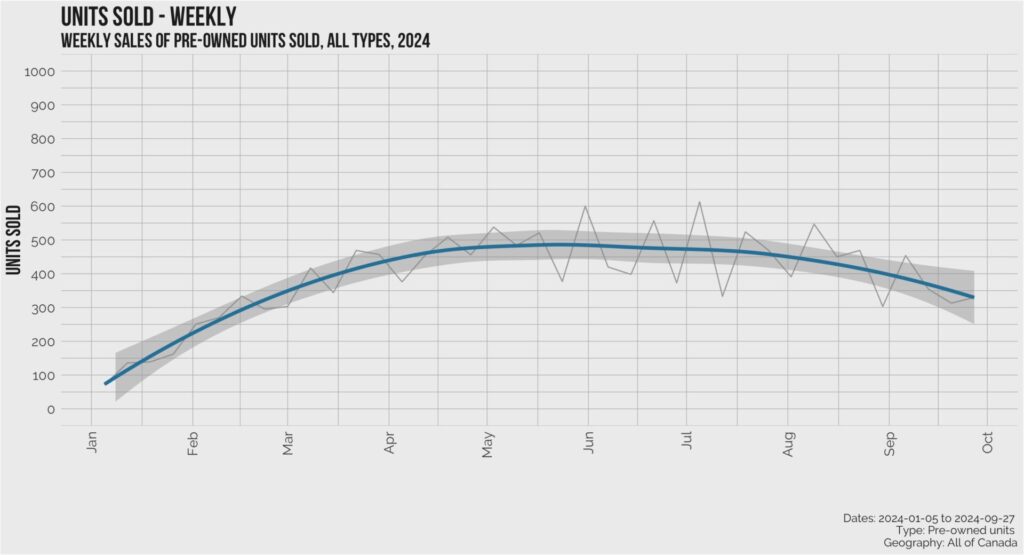

The pre-owned RV market in Canada experienced a slight dip in sales during Q3 2024, reflecting seasonal trends as the summer season came to a close. Between July and September, approximately 5,551 pre-owned RVs were sold across the country, a slight decrease from the 6,062 units sold in Q2. This drop aligns with typical seasonal behaviour as many consumers tend to make their purchases earlier in the year to get the most out of the summer season.

Despite the slight drop, several interesting trends emerged during Q3, particularly with respect to pricing, regional differences, and the types of RVs in demand. This article takes a closer look at these trends, providing insights into the fluctuations in sales and prices across various provinces and RV categories.

Sales Insights: A Small Dip, But Consistent Patterns

The average number of sales per week dropped slightly from 466 in Q2 to 427 in Q3.

The jagged grey line in the graph above shows the weekly number of sales from the start of the year to the end of September. April through August remain fairly stable, but as the summer season ends and colder weather arrives, sales begin to slow down.

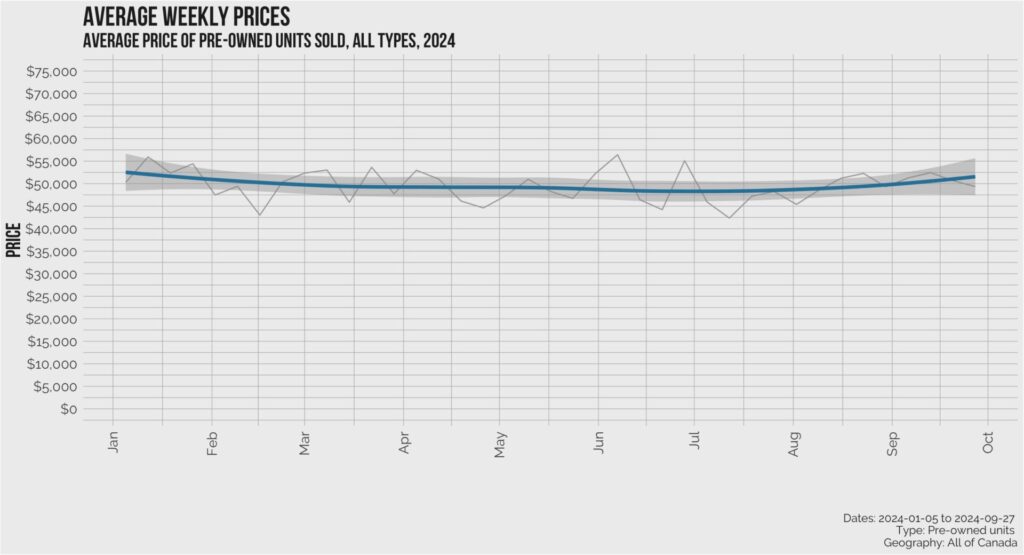

Price Insights: Stability with Minor Fluctuations

Prices remained fairly stable overall between Q2 and Q3, although there was some change depending on unit type. Class A and Class C Motorhomes saw a small drop in average price while Destination trailers saw a slight increase.

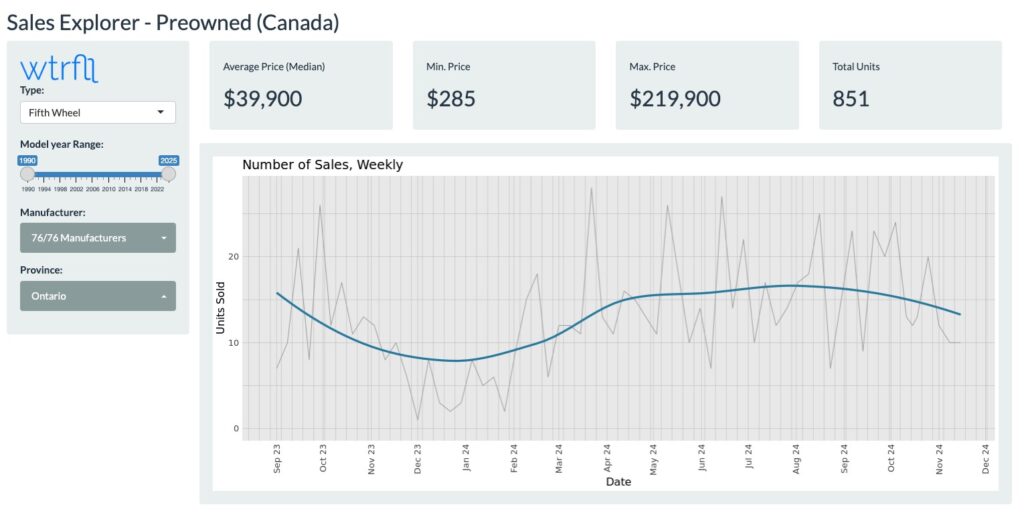

For a much deeper analysis, please visit the interactive dashboard at www.wtrfll.ca where you can access weekly analysis by province, RV type, manufacturer, and model year.

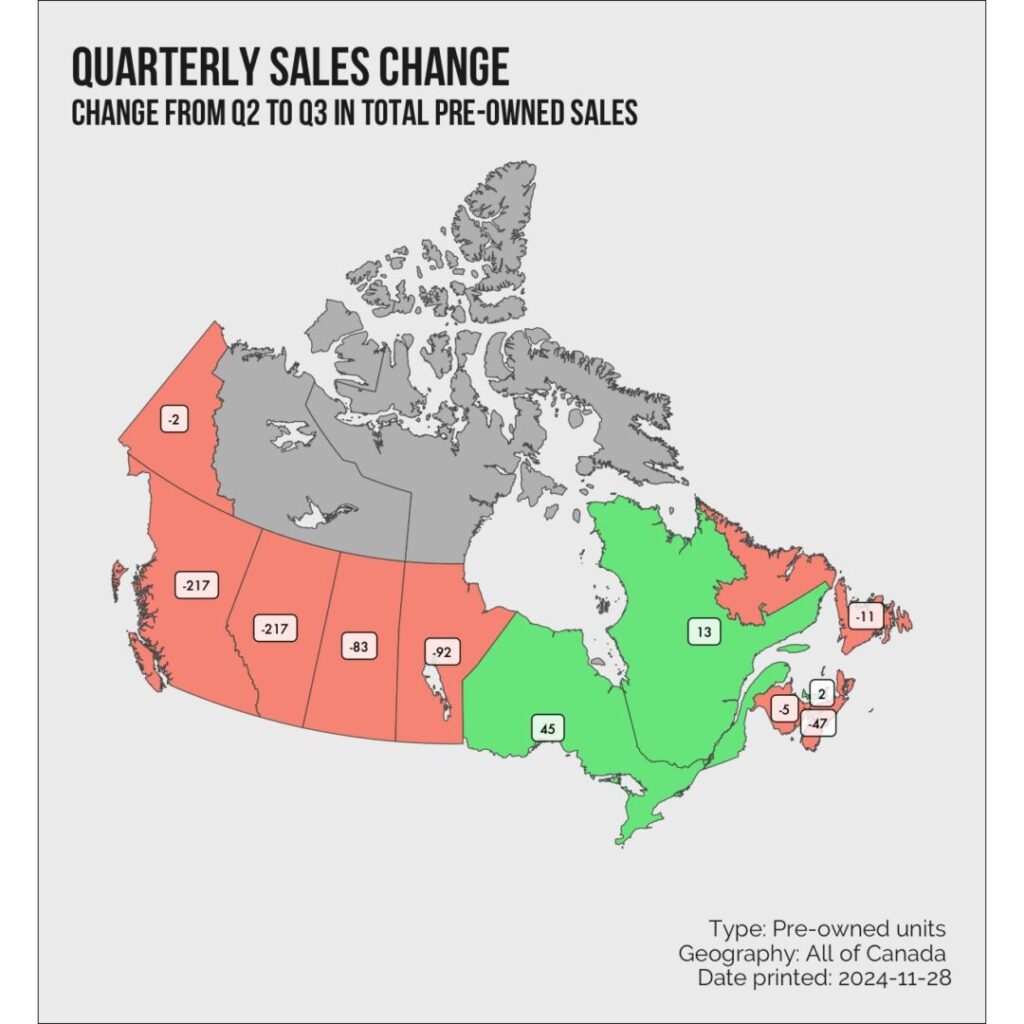

Location Insights: Regional Variations in Sales and Pricing

Ontario, Quebec, and PEI saw more sales in Q3 than Q2 with most provinces remaining fairly consistent in sales. British Columbia and Alberta both saw 200+ fewer sales quarter over quarter.

In terms of total pre-owned units sold, Ontario led the country at 1,650 with British Columbia in second place with 1,262.

Although British Columbia had fewer sales this quarter, the average price increased by more than 8% overall. Quebec and Ontario also saw slight increases in average prices while all other provinces were either neutral or lower.

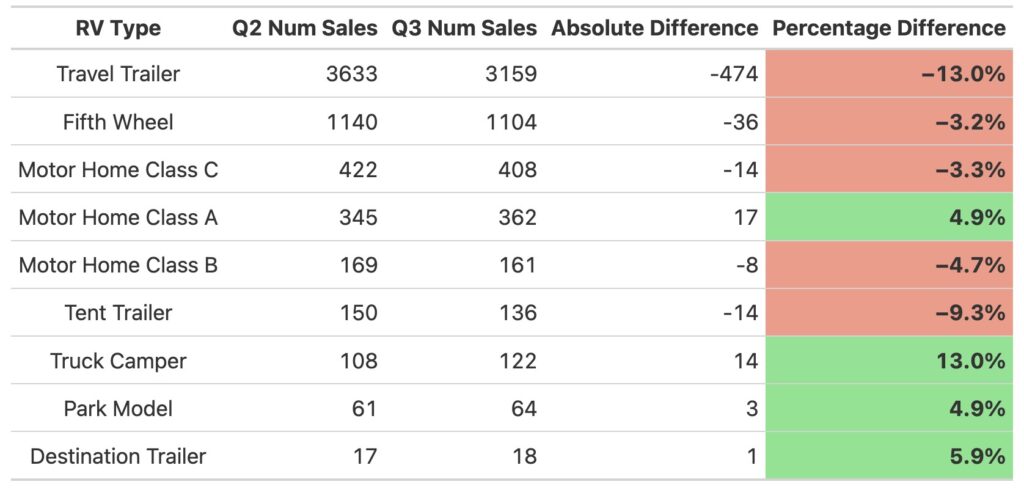

RV Types: Popular Categories and Market Shifts

Travel Trailers continued to be the highest selling type of RV in Q3, with 3,159 pre-owned unit sales seeing a 13% drop compared with the previous quarter. Fifth Wheel trailers were the second highest selling category with 1,104 sales in Q3, nearly the same as the previous quarter. Truck Campers saw an increase and most other categories were fairly consistent with the previous period.

In summary, quarter over quarter sales fell slightly but that was expected as the colder Canadian weather started to arrive. Sale prices of these pre-owned units remained fairly consistent with some drops in Atlantic Canada, and drops in motorized units.

For more detailed insights and weekly updated information on pre-owned RV trends across Canada, please visit www.wtrfll.ca for interactive dashboards and in-depth analysis by province, RV type, manufacturer, and model year.

About the author…

Nick Farnell, MBA

Nick Farnell is a professor of business analytics and runs the consulting firm wtrfll, focusing primarily on competitive intelligence and data driven insights. When not in front of a computer, he is spending as much time as possible in one of Ontario’s provincial parks with his young family.

Please vist https://wtrfll.ca/ to see how Nick and his team have helped organizations use data and analytics to better understand their customers and competitors.